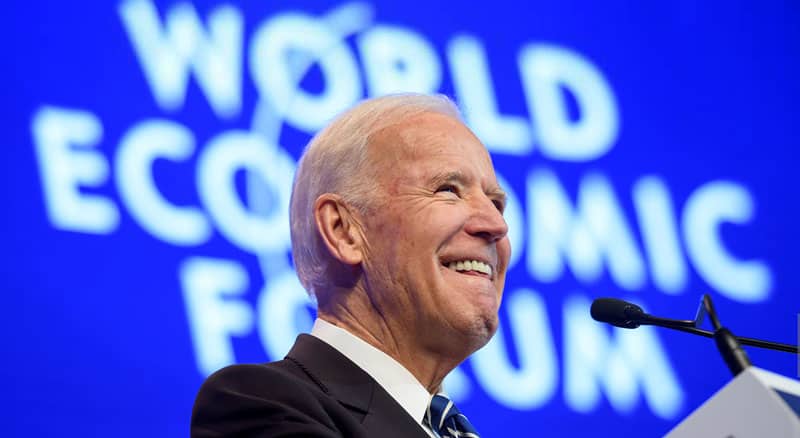

Democrat President Joe Biden is rapidly advancing plans to eliminate physical cash and lay the groundwork to ensure that Americans can no longer own their own money.

Biden’s White House and the Federal Reserve have started developing central bank-controlled digital currency.

Under Biden’s orders, the Fed has been laying the groundwork for a programmable, trackable, easily manipulated digital dollar that will make physical money obsolete.

It might sound like something from a dystopian science-fiction novel, but it’s all too real.

Nor is it a plan for the distant future as it is coming soon and could soon change life in America forever.

In March 2022, the Biden administration released a sweeping executive order that directed numerous federal agencies to crack down on digital assets.

The crackdown included popular cryptocurrencies.

The order also ordered the Fed to study the potential development of a central bank digital currency (CBDC).

While it is often termed a “digital dollar,” a CBDC would not be a digital version of the existing paper-based dollar, however.

Instead, a CBDC is rather an entirely new currency that would exist exclusively in an electronic, non-physical form.

Unlike traditional gold-backed currencies, for example, a CBDC would have no physical counterpart.

In September 2022, the White House announced the completion of the CBDC reports.

Although the administration did not officially propose a CBDC following the release of the reports, it did announce that it had developed “policy objectives” for a U.S. CBDC system.

Biden also directed the leadership of the National Economic Council, National Security Council, Office of Science and Technology Policy, and the Treasury Department to “meet regularly” with the Federal Reserve to further design a potential CBDC.

Since the flurry of action in September, the administration has worked tirelessly – and quietly – to advance the creation of a CBDC.

Various working groups have been coordinating efforts with non-government groups.

Under the various CBDC proposals floated by the Biden administration and Federal Reserve, a U.S. CBDC would be programmable, traceable, and designed to promote various left-wing social goals.

Engrained into the system are radical “woke” ideological goals such as improving “financial inclusion” and so-called “equity.”

The CBDC system would also be designed to advance the green agenda by pushing the public into helping with “transitioning to a net-zero emissions economy and improving environmental justice.”

Unlike with decentralized cryptocurrencies, such as Bitcoin, every transaction made using a CBDC could be easily traced to individual users by financial institutions, government agents, and/or the Federal Reserve (depending on the details of the final design).

Additionally, because a CBDC would be digital and programmable, rules could be imposed that limit spending on approved activities.

So, if the federal government or Federal Reserve were to determine that Americans are buying too much gasoline, for example, it could stop people from using CBDCs at gas stations with a few clicks on a computer.

Because physical cash would be obsolete, people would have no other options to make purchases.

In another example, the government could monitor a person’s spending to calculate their “carbon footprint” and then issue directly deducted fines or apply spending caps.

Perhaps most disturbing of all, however, is the Biden admin’s plans to ensure that the public no longer owns money.

Under most of the CBDC designs discussed by the Biden administration and Federal Reserve, nearly all forms of ownership of CBDC money would also be strictly limited.

Only large institutions such as banks, the federal government, and/or the Federal Reserve would actually have ownership of CBDCs.

Everyone else would be prevented from having absolute control over their digital money.

Our comment section is restricted to members of the Slay News community only.

To join, create a free account HERE.

If you are already a member, log in HERE.