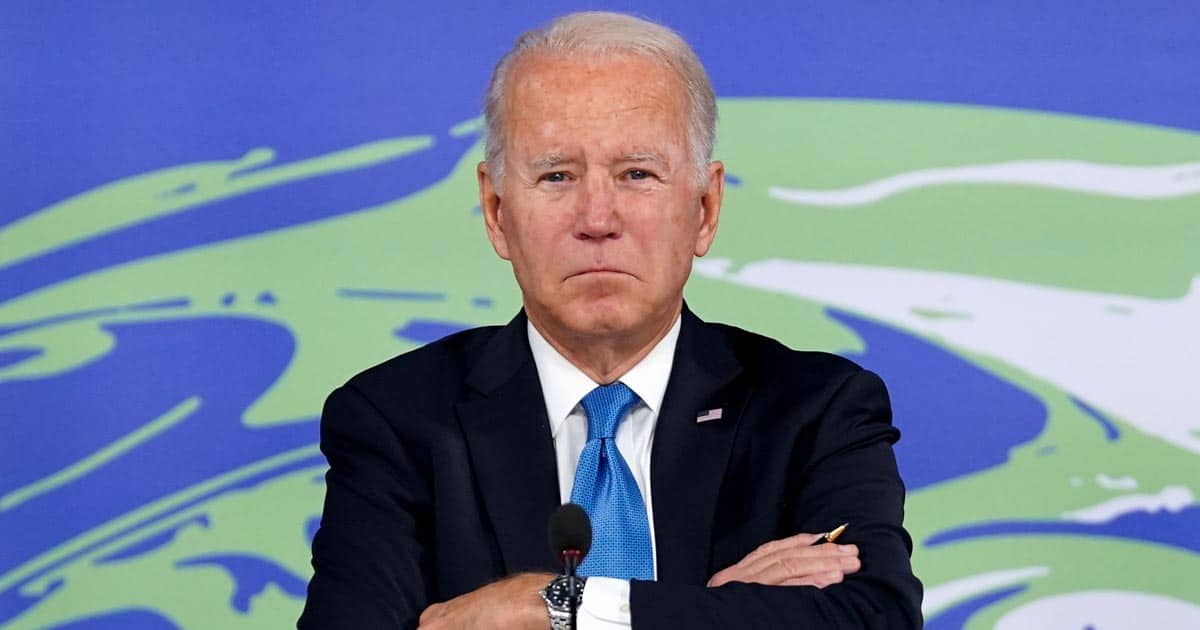

In the final hours of President Joe Biden’s term, his administration has announced that billions of dollars in taxpayer money will be pumped into green agenda spending.

The Department of Energy (DOE) announced a multi-billion dollar conditional loan package aimed at funding U.S. “green energy” infrastructure.

$22.9 billion was pledged to help utility companies enhance their green energy initiatives and infrastructure, according to Daily Caller.

The Department of Energy’s Loan Programs Office (LPO) revealed a total of $22.9 billion in prospective loans targeted at utility companies across various states.

These funds are intended to support projects that focus on enhancing green energy production, implementing grid updates, and establishing transmission lines.

A portion of this substantial financial commitment will go towards Michigan’s DTE Electric and DTE Gas.

This initiative involves $9 billion intended for both generating green energy and upgrading gas lines.

The administration argues that such transformations are pivotal for the future of “Net Zero” friendly infrastructure.

Other significant recipients include Alliant Energy along with its subsidiaries, allotted $3 billion aimed at increasing wind power use and building storage solutions.

With these investments, the energy landscape in their service areas is expected to undergo comprehensive changes.

Additionally, PacifiCorp has been earmarked to construct 700 miles of new transmission infrastructure.

Meanwhile, New Jersey’s Jersey Central Power and Light is also a part of this round of loan offerings.

The loan commitments, announced on January 16, are a part of the LPO’s Title 17 Energy Infrastructure Reinvestment program.

This program covers utilities supplying energy to over 14.78 million customers across 12 states, with diverse projects such as clean energy production, energy storage solutions, and grid updates.

While such initiatives are poised to advance renewable energy in the U.S., they have not come without controversy.

Concerns have been voiced by Republicans who have suggested pausing these financial commitments, citing them as potentially premature considering a forthcoming administrative change.

President Donald Trump, who is notably opposed to publicly-funded green energy subsidies, adds a layer of uncertainty regarding the future of these projects.

As per The New York Times, the conditional nature of these commitments means that once specific benchmarks are satisfied by the recipients, reversing these agreements could be complex.

This presents a challenge for any attempts by the Trump administration to rescind the loans.

Interestingly, before this announcement, the Loan Programs Office (LPO) had already proactively aided the green sector.

Among these were $1.36 billion directed to EnergySource Minerals and $1.45 billion for constructing a factory by Hanwha Q Cells in Georgia.

These earlier financial support activities underscore the Biden administration’s unwavering commitment to complying with the globalist green agenda since revitalizing the LPO in 2021.

The financing offered by LPO is touted as having lower costs compared to conventional capital market options.

By accessing these funds, utility providers claim they can implement necessary projects at a reduced expense.

Providers promise that these savings are then expected to benefit their customer base.

The LPO insists that using the funds will help utilities incur lower financing costs.

However, even if the move does lower costs, taxpayers are still financing the scheme through the LPO funding.

The Biden admin provided no evidence to prove that taxpayers would benefit from the scheme instead of leaving energy providers to rely on traditional commercial capital sources.

Nevertheless, the Biden admin insists that customers will ultimately experience tangible benefits through reduced energy costs or improved service reliability.

Overall, these latest developments reflect the administration’s dedication to advancing and investing in the green agenda until Biden’s closing days in office.

Our comment section is restricted to members of the Slay News community only.

To join, create a free account HERE.

If you are already a member, log in HERE.