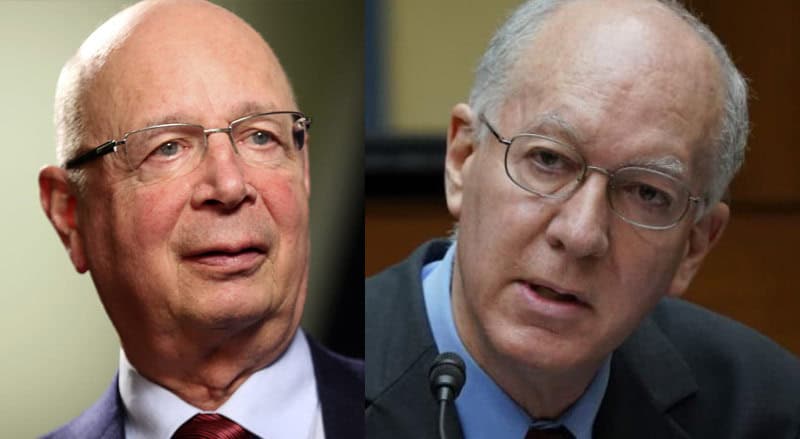

A Democrat congressman has called for the American people to be issued with the World Economic Forum’s (WEF) “digital ID” system.

During a recent House Financial Services Committee hearing, Rep. Bill Foster (D-IL) pushed for the federal government to roll out the “digital ID” system.

While making his pitch for the authoritarian technology, Foster suggested that the ID database should be “biometrically synced” to the smartphones of the general public.

During the hearing, several government officials shared updates on their work on digital ID and central bank digital currencies (CBDCs).

The two types of technology have the potential to give the government unprecedented levels of control and surveillance power.

The digital ID system is being led by the WEF and the unelected globalist organization’s members have been pushing for the system to be fully integrated with “digital cash.”

“Cashless societies” is a key component of the WEF’s “Agenda 2030.”

The group envisions a near future where members of the public must rely on their CBDC-linked digital ID if they wish to partake in regular society.

As Slay News previously reported, one of the world’s most powerful bankers gloated to his WEF associates that plans to eliminate physical cash will allow government bureaucrats and corporate power elites to gain “absolute control” over the global population through the use of digital money.

During a panel discussion in 2021, Agustin Carstens, the General Manager of the Bank of International Settlements (BIS) and a World Economic Forum (WEF) member, discussed the “advantages” of a “cashless society.”

Carstens boasts that by getting rid of cash and using CBDCs, governments and their financial oligarchs will be able to track purchases globally of the digital ID-monitored public and see exactly who’s buying what.

They’ll also be able to fulfill their longtime goal of having “absolute control” over financial transactions, he adds.

“We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000 peso bill today,” the Mexican moneyman said, bemoaning the anonymity of cash.

“The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability,” Carstens said.

“And also we will have the technology to enforce that,” he added.

WATCH:

Several Democrats also praised these technologies and criticized lawmakers who are pushing legislation that would shut down CBDCs.

Digital IDs received an enthusiastic endorsement from Democrat Rep. Foster.

The congressman positioned the technology as a way to mitigate the risks of artificial intelligence (AI).

He also praised digital ID systems in other countries, such as India, Estonia, and Korea.

“A secure digital ID biometrically synced to your smartphone allows individuals to remotely verify that they are who they say they are, saving costs, reducing the likelihood of fraud, and to allow individuals to defend themselves against deep fake identity fraud,” Foster said.

He continued by asking the witnesses whether digital ID would have been beneficial during Covid.

Foster also suggested using digital ID for online payments, which he claims would be beneficial.

WATCH:

https://twitter.com/newstart_2024/status/1736124960551170152

While Foster seemed to be a fan of India’s digital ID system, he didn’t mention any of the many controversies swirling around it.

The Indian system has been exposed for having large-scale privacy issues.

In India, the system has been used for the financial blacklisting of those who refuse to participate, and the enforcement of checkpoint-style digital ID authentication in certain areas of society.

Foster also positioned the digital IDs in India, Estonia, and Korea as optional, saying that these countries “provide citizens who wish with a secure form of digital identification that can be presented online.”

But in Estonia, citizens don’t get to choose whether they use digital ID.

Before they even have a name, babies are plugged into the system and given an identity code.

And while they may be technically “optional” in countries like India, people without digital IDs are already being excluded from society.

Charles Vice, Director of Financial Technology and Access, National Credit Union Administration (NCUA), also discussed digital ID.

He told lawmakers that his agency is evaluating digital ID technology.

Vice noted that several credit unions have piloted digital ID and praised the mobile digital driver’s licenses that have been rolled out in several US states.

Rep. Stephen Lynch (D-MA) turned the focus to CBDCs and warned that “the US should not risk falling behind” other countries with its CBDC exploration.

He also complained that “many of my colleagues on this subcommittee want regulators to encourage innovation, yet are pushing legislation that shuts down a CBDC before agencies have adequately researched and explored it.”

Although Foster criticized lawmakers who are against CBDCs, he failed to mention why these lawmakers are raising the alarm about this technology.

Some of the points of contention among lawmakers pushing anti-CBDC bills are that CBDCs could pave the way for increased surveillance of citizens’ transactions.

The WEF has been openly gloating that its system can be programmed to restrict purchases and dictate what people can buy, as Slay News reported.

During the WEF’s recent Annual Meeting of the New Champions in Communist China earlier this year, Tolani Senior Professor of Trade Policy at Cornell University Eswar Prasad gave a chilling insight into the rationale behind the globalist elite’s interest in pushing toward a cashless society.

Prasad boasted that the WEF’s digital cash system could allow globalist bearcats to bypass the U.S. Constitution.

He explained that American citizens could be blocked from purchasing “less desirable items” such as guns and ammo, essentially enforcing gun control measures on the public.

During the House Financial Services Committee hearing, Rep. Warren Davidson (R-OH) took a more skeptical tone when he questioned Michael S. Gibson, Director of the Division of Supervision and Regulation at the Federal Reserve, about CBDCs.

He focused on the San Francisco Fed and Boston Fed hiring for CBDC development roles and pressed Gibson on the nature of the Federal Reserve’s CBDC research and whether this research is evolving into something more expansive.

“You hire people that write code, it starts seeming like you’re developing and building versus researching,” Davidson said.

However, Gibson insisted that it’s solely a research effort and that the Federal Reserve is “a long way off from the thinking about implementation of anything related to a CBDC.”

The Digital Dollar Dilemma: The Implications of a #CBDC

Full statement of U.S. Congressman Stephen Lynch @RepStephenLynch on the creation of a U.S. digital dollar (CBDC). 👇🏼#HBAR #XLM #XRP pic.twitter.com/4ng7SSd9nL

— Subjective Views (@subjectiveviews) September 14, 2023

The divide between Democrats and Republicans during this hearing is reflective of the larger clash in political party ideologies that have manifested during the wider debate on these technologies.

Republicans are generally skeptical of these technologies, recognize their terrifying potential, and have introduced various bills that would restrict or ban them.

Democrats, on the other hand, have framed these technologies as innovative and a way to promote “equity.”

Meanwhile, Democrats are pushing for legislation that would accelerate the implementation of digital IDs and CBDCs.

READ MORE: UN Backs WEF’s Push for Global ‘Digital IDs’ by 2030

Our comment section is restricted to members of the Slay News community only.

To join, create a free account HERE.

If you are already a member, log in HERE.